The coin market has been evolving quickly over the past 24 months. Here are five collecting trends that I see making a big impact in the rare date gold market in 2022.

1. The Return of the 12-Piece Type Set

This collecting trend died in the 1980s, but it is making a comeback in 2022. This set consists of three gold dollars, two quarter eagles, one three-dollar piece, two half eagles, two eagles, and two double eagles.

Typically, all the coins in this set are uncirculated, with most grading at least MS63 to MS64. Every type in this 12-coin group is obtainable in MS65, although the Indian Princess Three Dollar and the Indian Head Half Eagle are challenging.

To make this set a bit more interesting, I would suggest adding “plus” coins (i.e., PCGS MS64+) when sensible and involving better dates; again, when sensible.

2. The Return of the Type One Liberty Head Double Eagle Market

Due to the impact of thousands of Type One Double Eagles entering the market as the result of the Fairmont Hoard, the market for most of this series suffered price meltdowns in 2018-2020.

In 2021, the market for Type One Double Eagles saw price increases for slightly better dates in AU and Uncirculated grades. In 2022, I see this segment of the market showing further strength as more collectors become interested in this challenging series.

Type Ones truly have “something for everyone,” as issues range from $2,000 to $500,000+. A trend within this market that I can see gaining traction in 2022 is a “year set” of Type One Double Eagles, which includes one example from each of the 17 years during the time this design was produced.3. Trophy Coins Soar in Demand and Price

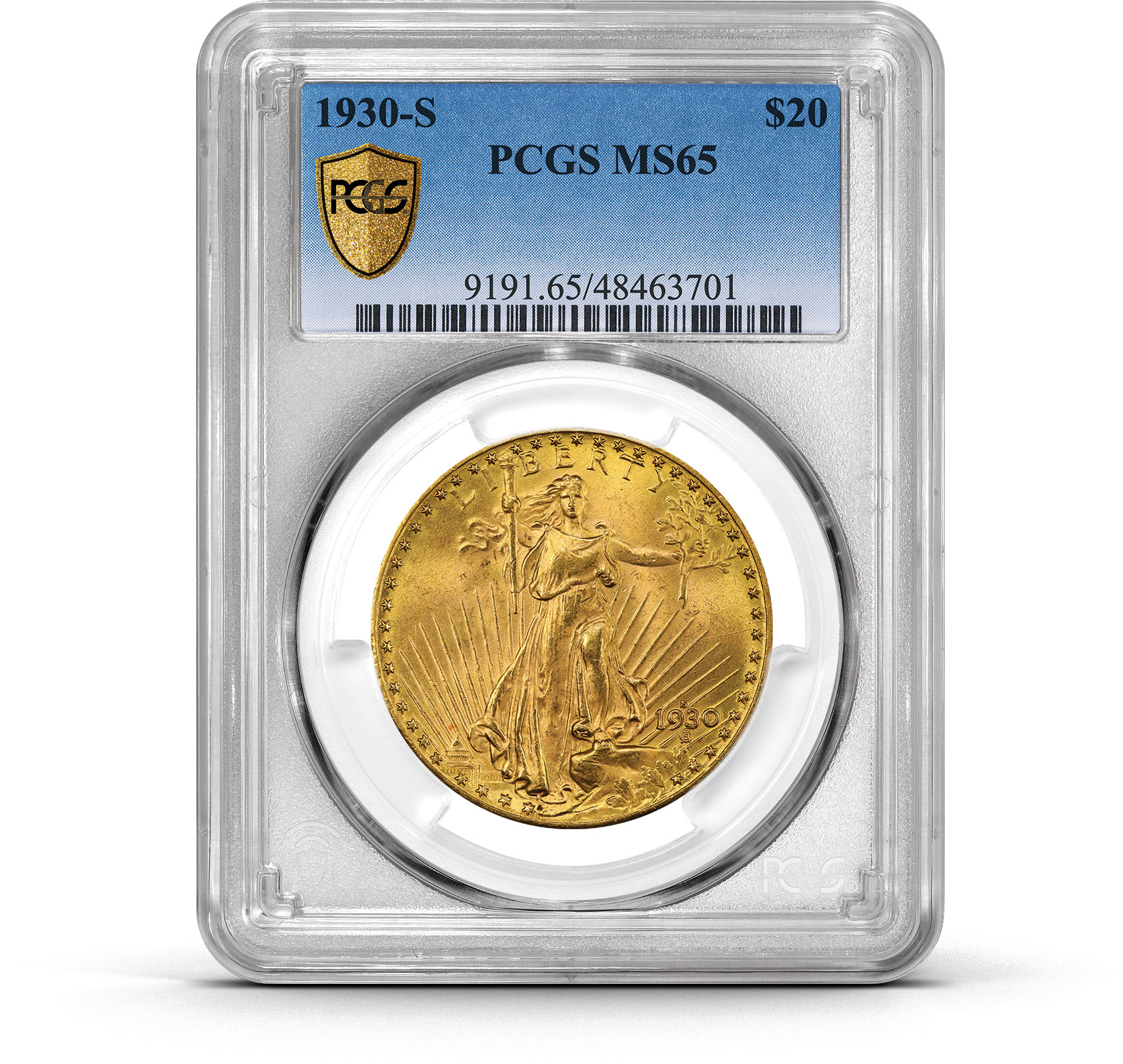

There appears to be plenty of new money in the 2022 coin market, and much of the high-priced items are trophy coins. These aren’t necessarily the trophy coins of yore, such as Stellas, 1907 High-Relief Double Eagles, Wire-Edge Indian Head Eagles, and Panama-Pacific $50s.

Trophy coins of 2022 struck in gold include high-denomination proof gold, choice and gem early gold (especially coins dated prior to 1800), ultra-rare Territorial and Pioneer issues, finest-known examples, or high condition census branch-mint rarities and coins with great eye appeal.

4. “Jump Coins” Become Popular (Again)

Many years ago, I wrote about a concept that I called “jump coins.” This entails buying good coins at the exact price point before they explode in value.

Let’s say we’re looking at a rare-date Dahlonega quarter eagle listed in price guides for $7,500 in AU55 and $18,500 in AU58. If I were offered a nice original piece in an AU55 holder for $8,500 and had a chance to purchase a different example in an AU58 holder that was also a nice coin for $20,000, it is very likely that I’ll buy the lower-priced coin as it is likely a better value.

Of course, this isn’t true 100% of the time. In the case of the Dahlonega quarter eagle mentioned above, if the AU58 represents the best-available quality for the issue and it has a low population, I might well pay up for the higher-graded coin.

5. Pricing Coins Becomes Very Difficult

In a very strong market, like we are experiencing in 2022, it is almost impossible to find accurate pricing. A lot of this has to do with the difficulty of keeping up with price changes, especially when they occur rapidly. Another issue is how much does one extremely strong transaction impact the market.

Let’s look at a random example.

In November 2021, Heritage Auctions sold a PCGS AU58 1882-CC Double Eagle for $18,000. At the time the PCGS coin was sold, price guide information showed a value of $7,000. After this sale, the price was increased to $8,750, and it was increased again in January 2022 to $11,000. The market for CC-mint double eagles is very deep, and clearly this one price was an outlier. But it tells me that this coin is difficult to price right now.

Copper & Nickel

Copper & Nickel

Silver Coins

Silver Coins

Gold Coins

Gold Coins

Commemoratives

Commemoratives

Others

Others

Bullion

Bullion

World

World

Coin Market

Coin Market

Auctions

Auctions

Coin Collecting

Coin Collecting

PCGS News

PCGS News